カテゴリー

10,000円以上のご購入で

送料無料!

N-BAG

現在のページを携帯やスマートフォンで見る場合、QRコードを読み込んでください。

ポイントについて

ポイント制度をご利用になられる場合は、会員登録後ログインしてくださいますようお願い致します。

ポイントはご購入金額の1% が付与されます。

次回商品購入時に1pt = 1 円 として使用することができます。

次回商品購入時に1pt = 1 円 として使用することができます。

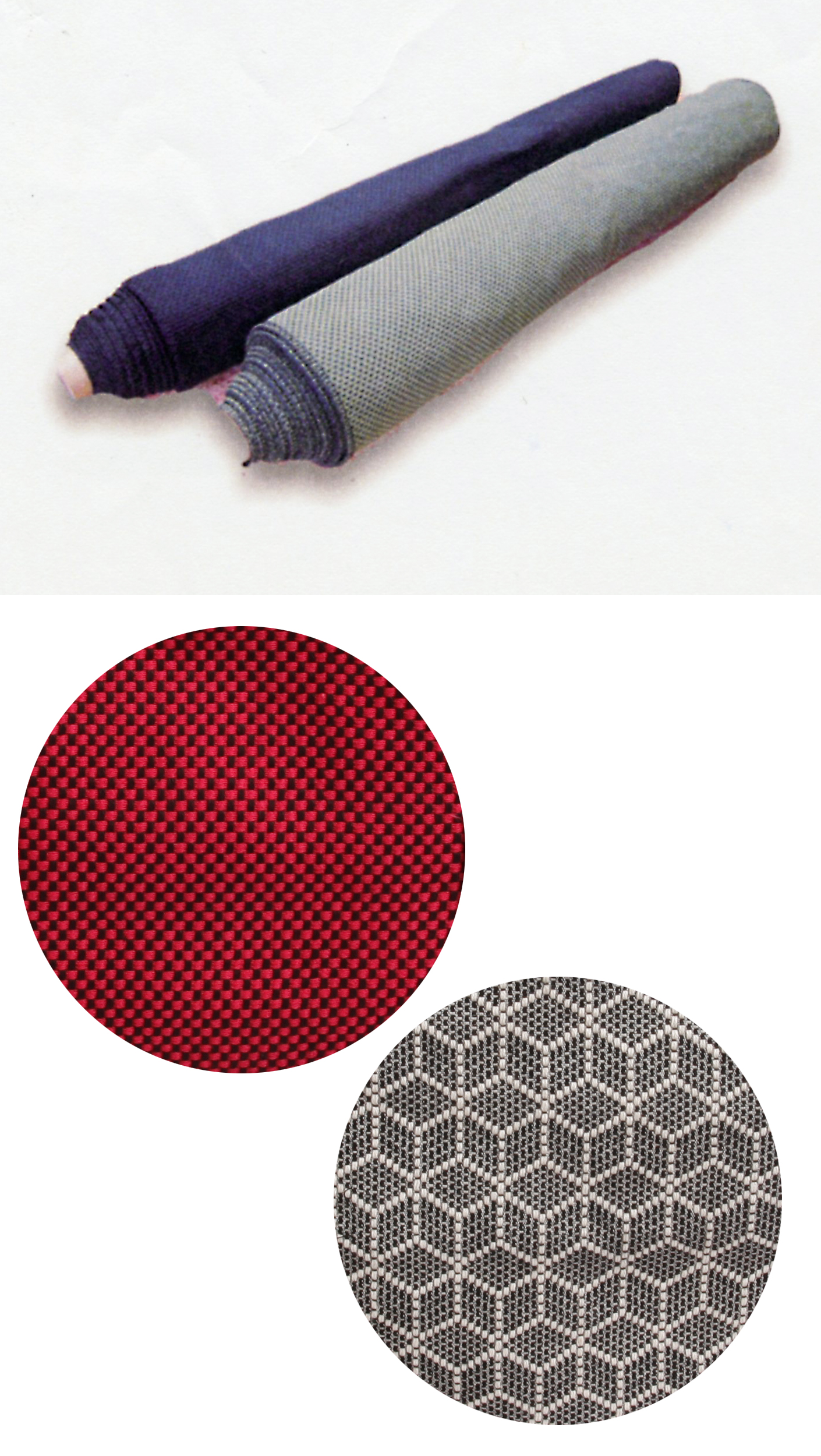

- 刺子素材を主としたバッグ専門店です。日本の伝統手工芸技法「刺子」をモチーフに職人がカバンを手作りします。

JAPANESE TRADITIONAL HANDCRAFT"SASHIKO"

日本の伝統手工芸技法「刺子」

刺子は日本で古くから使われてきた伝統手芸です。衣服を摩擦等に対して補強したり保温性を高めるために重ねた布を刺し縫いしたのが始まりだと言われています。

布を重ね合わせる、一針一針手縫いする、という技法からか、魔除けや豊作祈願・商売繁盛祈願といった人々の想いも込められていたそうです。

現代では、刺子手芸の技法も受け継がれていると同時に、刺し子の表情を再現できるように織った「刺子織り」が工業化されています。

N-BAGでは、この堅牢でありながらエレガントな表情を持つ刺子素材を使用し、熟練の職人がバッグを製作しています。

オススメ商品

ご注文の流れ

ご注文

「カートに入れる」ボタンをクリックすると「ショッピングカート」に数量と金額が表示されますので「レジに進む」ボタンをクリックしてください。

お客様情報

会員でログインしていない場合はログイン画面が表示されます。会員登録をお願いいたします。登録後、カートへ進んでください。「ゲスト購入」も可能です。

ご注文内容のご確認

お届け先の指定やお支払い方法等をご入力いただきましたら、内容をご確認の上、「注文する」をクリックしてください。当店より注文受付メールが自動配信されます。

入金・発送

当店で入金確認ができ次第、商品の発送準備を進め、発送が完了しましたら、メールでお知らせいたします。

ショッピングガイド

お支払いについて

当店では、銀行振込、代金引換をご用意しております。

■銀行振込

下記の銀行口座にお振り込みください。

振り込み手数料はお客様負担でお願いします。

口座情報

***********************************

浜松磐田信用金庫 福田支店

ハママツイワタシンヨウキンコ

フクデ シテン

普通 5044957

受取人名 オオバ ナオコ

***********************************

■代金引換

手数料がかかります。

■銀行振込

下記の銀行口座にお振り込みください。

振り込み手数料はお客様負担でお願いします。

口座情報

***********************************

浜松磐田信用金庫 福田支店

ハママツイワタシンヨウキンコ

フクデ シテン

普通 5044957

受取人名 オオバ ナオコ

***********************************

■代金引換

手数料がかかります。

返品・交換について

返品・交換をご希望の場合には、商品到着後1週間以内に当店まで、メールまたはお電話にてご連絡ください。

ご連絡をいただいてから、1週間以内に当店宛てにご返送をお願いしております。

なお、上記の期限を過ぎてからのご連絡は、返品・交換をお受けできかねます。

ご連絡をいただいてから、1週間以内に当店宛てにご返送をお願いしております。

なお、上記の期限を過ぎてからのご連絡は、返品・交換をお受けできかねます。

送料について

お買い上げごとに送料をいただいております。

10,000円以上お買い上げいただきますと送料無料になります。

10,000円以上お買い上げいただきますと送料無料になります。

配送について

配送は佐川急便でお届けします。

地域や商品の大きさによりましては、物流会社が変更になることもございますが、何卒ご了承ください。

地域や商品の大きさによりましては、物流会社が変更になることもございますが、何卒ご了承ください。

N-BAG

〒 4371204

静岡県磐田市福田中島1175

電話:0538583317

営業時間

9:00~19:00

・ネットでのご注文は24時間受け付けております。

・お問い合わせは、お問い合わせフォーム メール お電話で受け付けております

静岡県磐田市福田中島1175

電話:0538583317

営業時間

9:00~19:00

・ネットでのご注文は24時間受け付けております。

・お問い合わせは、お問い合わせフォーム メール お電話で受け付けております